Remitly: Send or Transfer Money Abroad Online from the United States

Are you looking for a reliable way to send money abroad online? For anyone living in the United States, Remitly is the perfect solution. It offers an easy and secure way to transfer money overseas, with low fees and competitive exchange rates. In this blog post we’ll look at what Remitly is, how it works, and why it’s become one of the most popular services for sending international payments. We’ll also discuss some of the benefits of using Remitly over other remittance services.

What is Remitly?

When you need to send money to friends or family abroad, Remitly offers a convenient and affordable solution. With our international money transfer service, you can send funds quickly and securely to over 125 countries.

Remitly is a digital platform that makes sending money abroad easy and affordable. We offer competitive exchange rates and fees, and our simpleTransfer process only takes a few minutes. Plus, we have a mobile app so you can send money on the go!

If you’re looking for an alternative to traditional wire transfer services, Remitly is the perfect solution. We offer fast transfers, great rates, and 24/7 customer support.

How to send money with Remitly

If you’re looking to send money abroad, Remitly is a great option. With Remitly, you can send money online from the United States to over 130 countries. Plus, there are no hidden fees and your first transfer is free. Here’s how to send money with Remitly:

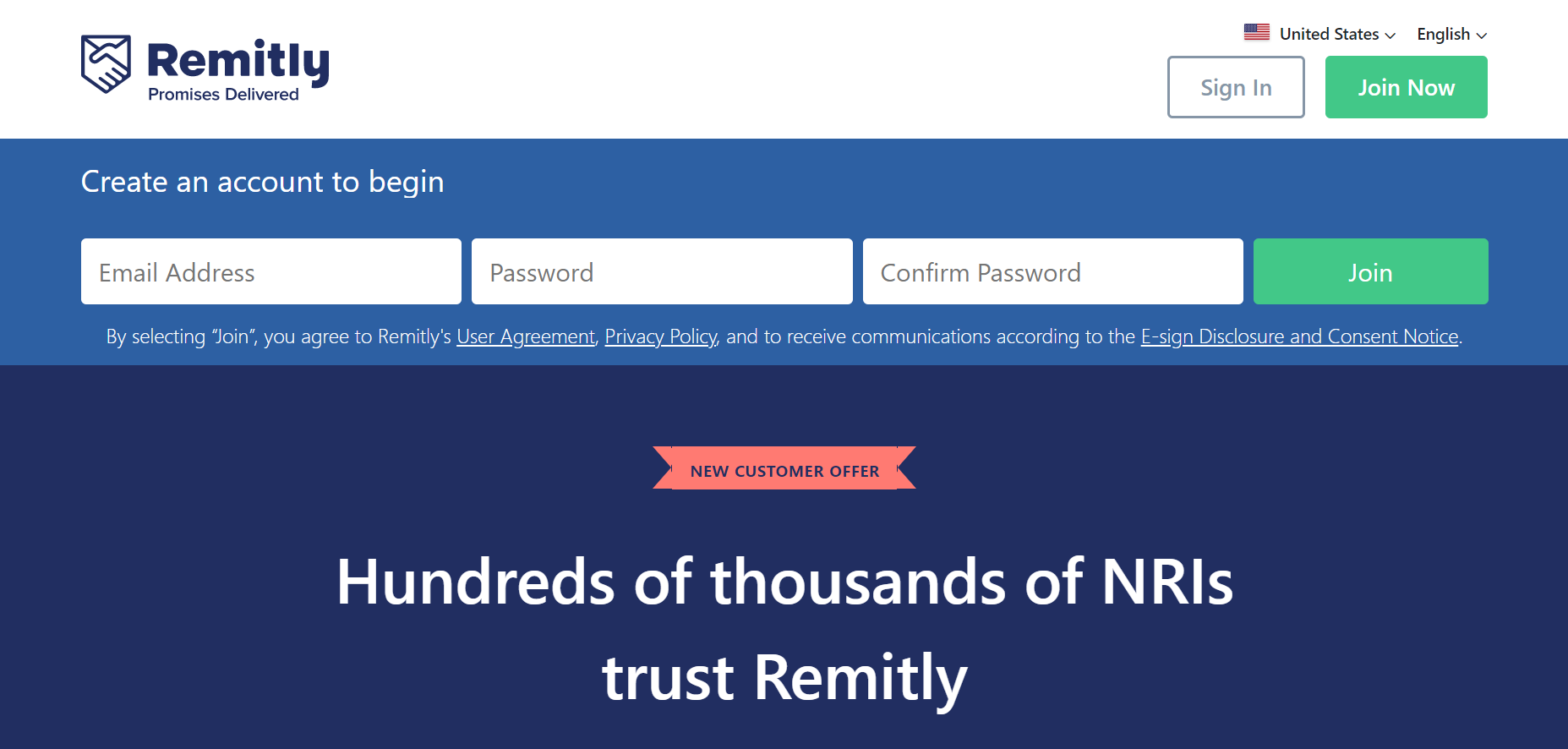

1. Create an account. Sign up for a free account at Remitly.com.

2. Enter your recipient’s information. To get started, you’ll need to enter your recipient’s name, address, and phone number. You can also add a photo of your recipient if you’d like.

3. Choose how you want to pay. You can pay with your bank account or with a credit or debit card.

4. Enter the amount you want to send and choose when to send it. On the next page, you’ll be able to enter the amount of money you want to send as well as choose when you want it to be delivered (within minutes, hours, or days).

5. Review and confirm your transaction. Before you finalize your transaction, be sure to review all of the details carefully so that everything is correct. Once everything looks good, hit “Confirm” and your money will be on its way!

Fees and rates

At Remitly, we believe that sending money abroad should be easy, fast, and cost-effective. That’s why we have a simple and transparent fee structure for our money transfer services.

When you use Remitly to send money abroad, you will pay a transfer fee. The transfer fee is a percentage of the amount you are sending, and it depends on the country you are sending to. For example, the transfer fee for sending $500 to Mexico is $3.99.

In addition to the transfer fee, you will also be charged an exchange rate fee. The exchange rate fee is a charge that covers the cost of exchanging your currency for the currency of the country you are sending to. For example, if you are sending USD to CAD, there is a small exchange rate fee of 2.5%.

The total cost of your transfer will be the sum of the transfer fee and the exchange rate fee.

Pros and cons of using Remitly

When you need to send or receive money internationally, there are a few different ways to do it. You could use a bank, which can be expensive and slow, or you could use a wire transfer service like Western Union or MoneyGram. Or, you could use an online money transfer service like Remitly.

Remitly is a digital money transfer service that lets you send and receive money internationally without having to go through a bank. It’s fast, convenient, and relatively affordable. In this article, we’ll go over the pros and cons of using Remitly so you can decide if it’s the right choice for your needs.

Pros:

-Fast: Remitly transfers are typically processed within minutes, so you won’t have to wait days or weeks for your money to arrive.

-Convenient: With Remitly, you can send and receive money from the comfort of your own home. There’s no need to go to a bank or wire transfer office.

-Affordable: Remitly’s fees are often lower than those of banks and other wire transfer services. And, if you sign up for a monthly plan, you can get even lower rates.

Cons:

-Restrictions: Some countries have restrictions on how much money can be sent into or out of the country via Remitly. Be sure to check the restrictions

Alternatives to Remitly

In addition to Remitly, there are a number of other companies that offer money transfer services. Some of the most popular alternatives to Remitly include:

Each of these companies has its own strengths and weaknesses, so it’s important to compare them before choosing one. For example, WorldRemit is generally cheaper than Remitly, but it doesn’t have as many pickup locations. TransferWise is often faster than Remitly, but it doesn’t offer mobile phone top-ups.

Ultimately, the best company for you will depend on your specific needs and preferences. Be sure to do your research before selecting a money transfer service!

Conclusion

Remitly is an excellent way to transfer money abroad online from the United States. With its competitive rates, fast turnaround times and reliable customer service, Remitly makes it easy to send or receive your money overseas with a few clicks of the mouse. Whether you’re sending funds for business or personal reasons, Remitly has got you covered. Give them a try today and see how they can help make your international transfers easier and more affordable!