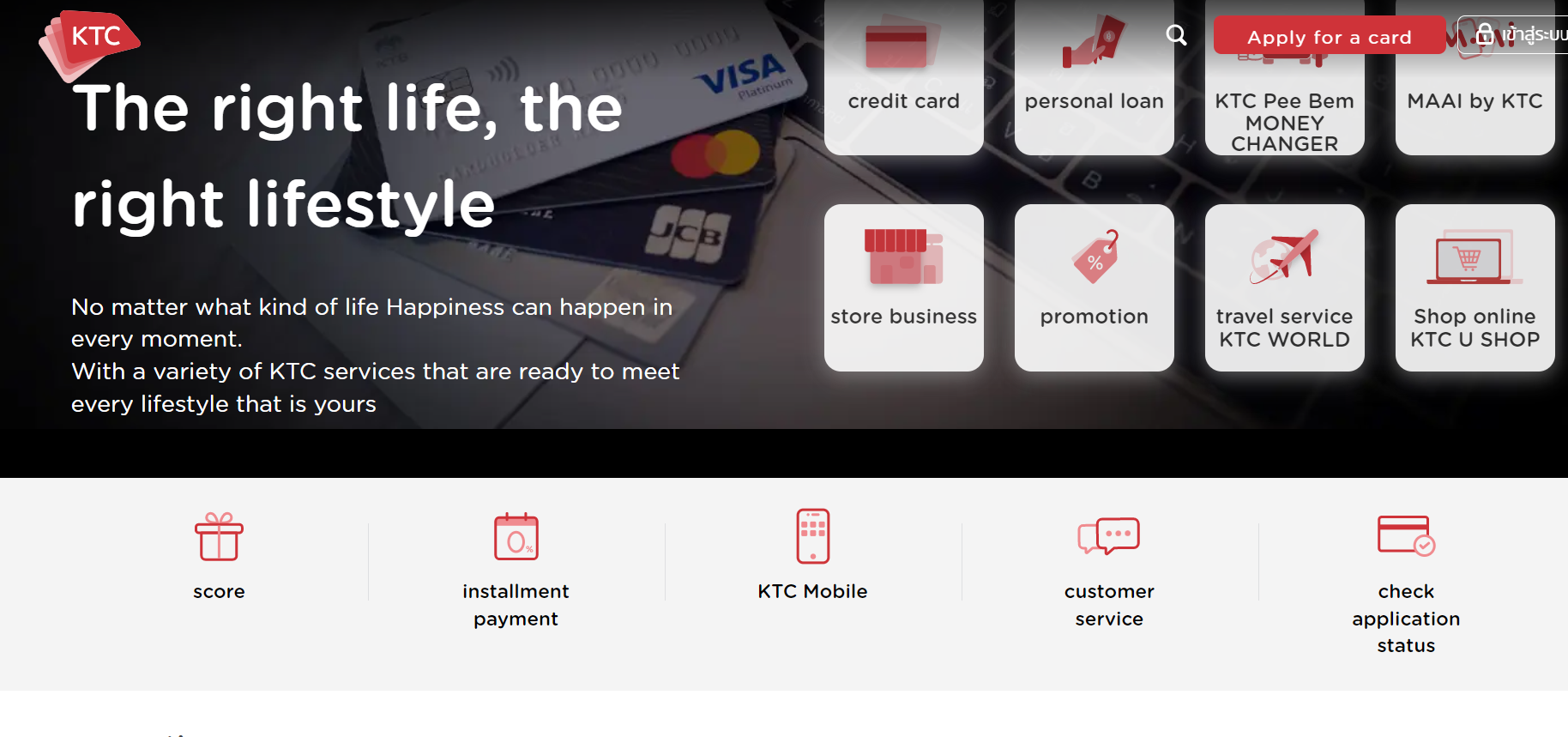

Are you in search of a reliable and trustworthy financial institution to cater to your banking needs? Look no further than Krungthai Card Public Company Limited (KTC)! With years of experience in the industry, KTC has established itself as one of Thailand’s leading credit card providers. From flexible payment options to exclusive perks and rewards, this blog post will guide you through everything you need to know about KTC and how it can benefit you. So, let’s dive right into what makes KTC stand out from the rest!

Are you on the lookout for a reliable credit card provider in Thailand? Look no further than KTC, short for Krungthai Card Public Company Limited. With years of experience under their belt and a range of flexible options to suit your needs, KTC is quickly becoming the go-to choice for savvy consumers across the country. So why wait? Join the thousands of satisfied customers who have already made the switch to KTC today! In this blog post, we’ll take a closer look at what makes KTC such a standout provider and explore some of their most popular products and services.

KTC Overview

Krungthai Card Public Company Limited (KTC) is a subsidiary of Krungthai Group. The company was founded in 1999 and commenced operations in 2000. KTC provides various financial products and services to its customers, including Krungthai Card, Krungthep Card, Krungthep Money Transfer, and Krungthai Credit Loan. In addition to these core products, the company also offers insurance and investment products.

The company’s customer base consists of both individuals and businesses. KTC has more than 1 million cardholders and operates in Thailand, Cambodia, Laos, Myanmar, Indonesia, Malaysia, the Philippines, Singapore, Brunei Darussalam and Vietnam. In terms of market share, KTC is the leading issuer of credit cards in Southeast Asia with a total market share of approximately 50 percent.

Krungthai Group is one of Thailand’s largest conglomerates with interests in various industries including banking/finance (Krungthai Bank), retail (Big C), hospitality (Dusit Thani Group), food & beverage (Foodland Group), real estate (Prime Property Holdings Ltd.), technology (Thaiphone Co., Ltd.), entertainment (Siriraj Entertainment Division), car manufacturing (Toyota Motor Manufacturing Thailand Corporation) and other businesses such as waste management [1]. The group employs more than 337 thousand people across its subsidiaries.

KTC’s primary

Krungthai Card Public Company Limited (KTC) is Thailand’s leading prepaid card company, providing convenient and flexible payment solutions for a wide range of customers. The company was founded in 1993 and has since become one of the country’s leading providers of financial services. KTC operates a network of over 1,000 authorized outlets across Thailand and offers a range of products and services, including the Krungthai Card, which is one of Thailand’s most popular prepaid cards. The Krungthai Card is available to purchase at over 1,000 authorized outlets nationwide and can be used to make purchases at participating merchants across Thailand. The card also provides access to exclusive benefits, including special discounts and exclusive privileges.

Recent Developments at KTC

Krungthai Card Public Company Limited (“KTC”) is a leading issuer of payment cards and smartcards in Thailand. The company offers a full range of traditional and digital payment products to consumers and businesses in Thailand. KTC is headquartered in Bangkok, with regional offices throughout the country. In fiscal year 2018, KTC reported total revenue of THB 6,829 million, representing an increase of 4% over the prior year. The company’s net income attributable to shareholders was THB 1,796 million in fiscal year 2018, an increase of 11% over the prior year.

KTC continues to make significant progress on its growth strategy and initiatives. In March 2019, KTC joined forces with Mastercard as the exclusive global card provider for Krungthai Card’s loyalty program member base of more than 20 million members. The agreement will enable Krungthai Card customers to enjoy increased benefits including exclusive discounts and special offers from merchants across Thailand. This partnership is another key step forward for KTC as it seeks to grow its customer base and expand its business across all channels.

In addition to its focus on expanding its customer base and expanding into new markets, KTC has also been focusing on improving its operational efficiency. To this end, the company has launched a number of initiatives aimed at streamlining its business process and enhancing its overall operations capabilities. These include the implementation of a data-driven decision making platform that allows managers to

Future Outlook for KTC

Krungthai Card Public Company Limited (KTC) is a public company listed on the Thai stock exchange. It was incorporated in 1979 and operates as a credit card issuer, providing merchant services and issuing electronic payment cards. In fiscal 2016, KTC reported consolidated revenue of THB 4.02 billion, up 12 percent from the previous year. The company operates in Thailand and its regional markets including Cambodia, Laos, Myanmar and Vietnam. KTC has over 1 million active customers and employs more than 2,000 people. The company plans to grow its business through new product launches and expansions into new markets.

The Krungthai Card Public Company Limited (KTC) is one of Thailand’s leading transportation operators with a fleet of over 2,700 buses and coaches. The company operates a number of bus services in Bangkok as well as other major Thai cities. KTC has also been expanding its operations into neighboring countries such as Laos and Cambodia.

Over the next few years, KTC expects to continue its expansion in new markets and increase both the passenger and cargo volumes through its bus services. The company is also planning to build new bus stations across Thailand, which will help improve customer satisfaction and reduce operating costs. In addition, KTC is investing in new technology to improve efficiency and reliability of its bus services.

Conclusion

KTC is a publicly traded company with operations in Thailand. The company manufactures and distributes motorcycles, bicycles, automotive parts, electronic equipment and other products. In 2017 the company generated revenue of THB 2,603 billion and EBITDA of THB 346 billion. KTC has a solid track record of growth over the past few years, with projected growth rates exceeding 10% for both 2017 and 2018.

KTC is a public company with operations in the transportation and logistics sector. The company offers its shareholders attractive dividends, which have helped it maintain a strong capital base. KTC has been able to maintain its market share despite stiff competition from larger companies. The company’s flagship product, Krungthai Card, provides customers with an easy way to pay for goods and services at participating merchants.