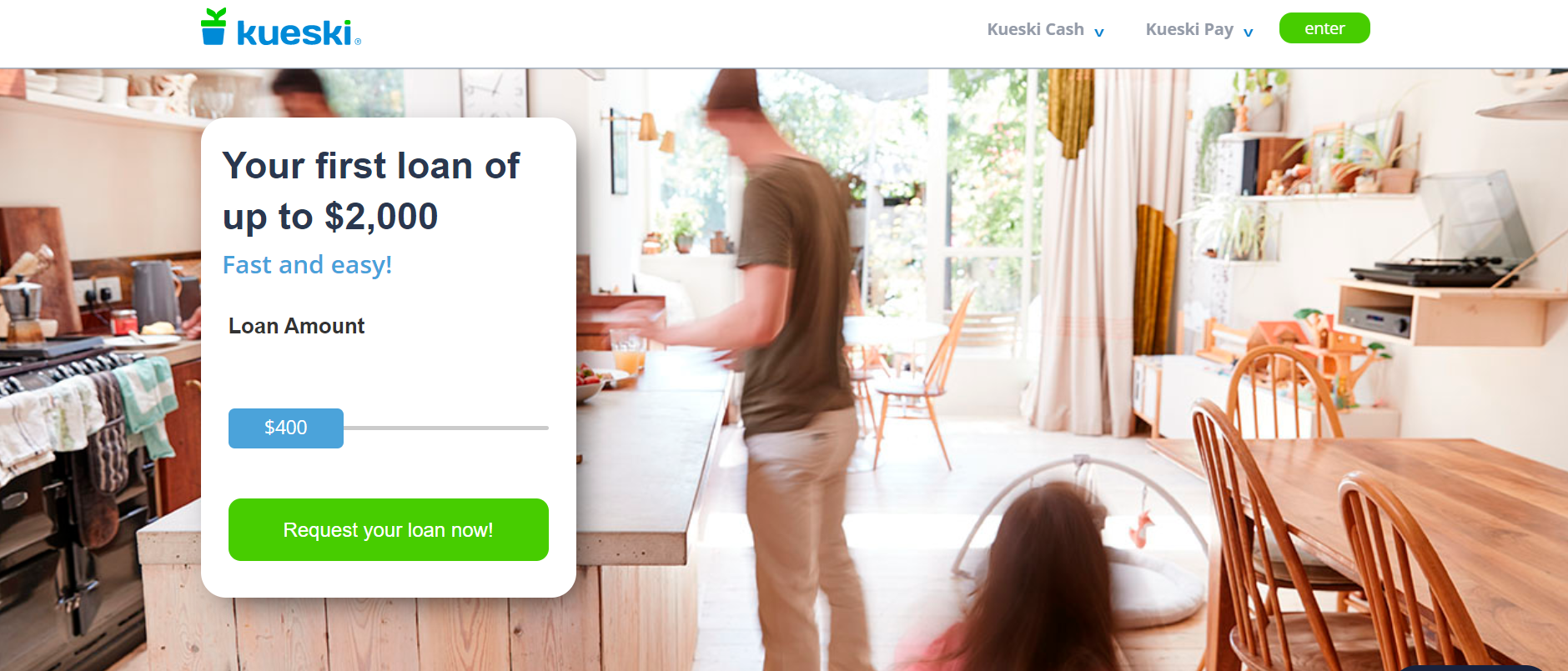

Are you in urgent need of cash but don’t have the time to wait for traditional bank loans? Look no further than Kueski! Offering immediate personal loans and quick loans, Kueski has revolutionized the lending industry by providing fast and convenient financial solutions. In this blog post, we’ll explore everything you need to know about Kueski’s services, from their application process to their repayment options. So sit back, relax, and let us guide you through the world of instant personal loans with Kueski.

In today’s fast-paced world, unexpected expenses can pop up at any given moment. Whether it be a medical emergency or a sudden car repair, having access to immediate personal loans can be a lifesaver. And that’s where Kueski comes in- offering quick and hassle-free loans for those who need them most. In this blog post, we’ll explore everything you need to know about Kueski and how they’re changing the game when it comes to personal lending. So buckle up and get ready to learn all about the power of instant cash!

What are quick personal loans?

A quick personal loan is a type of loan that can be approved and funded in just a few minutes. These loans are perfect for situations where you need money quickly, but don’t have the time to wait for a longer traditional loan process.

Quick personal loans come in a variety of options, so you can find one that meets your needs. Some Quick Personal Loans allow you to borrow as much as $5,000 in as little as 30 minutes. You can also choose Quick Personal Loans with lower interest rates and shorter repayment periods, if you need help getting through a tough financial situation.

Quick Personal Loans make it easy to get the money you need when you need it – so take advantage of our fast and easy online application process today!

How do quick personal loans work?

Personal quick loans are usually short-term, small-dollar loans that you can take out quickly and easily. They’re perfect for when you need a quick infusion of cash but don’t have the time or patience to wait for a traditional loan application process.

To get a quick personal loan, all you need is some basic information about your financial situation and your credit score. You can then fill out a simple online form, and within minutes you’ll be approved for the loan amount you need.

Quick personal loans are typically fast and easy to get, with few if any requirements other than basic information about your financial situation and credit score. Personal loans are perfect for those in a hurry who don’t have the time to go through the more formal loan application process.

How much can you borrow with an immediate personal loan?

If you need a small loan now and don’t have time to wait for a traditional bank loan to come through, there are quick personal loans you can take out. These loans are available from online lenders and can be approved in just a few minutes. The average APR for an immediate personal loan is around 17%. However, this will vary depending on the lender and the terms of your specific loan.

Looking for a quick and easy way to get some cash? Check out our selection of immediate personal loans. These loans are perfect for times when you need money right away, and they come with low interest rates that make them an affordable option. Plus, they’re available in a variety of denominations so you can find the right one for your needs. So whether you need a small loan to cover a short-term emergency expense or a larger loan to help you cover larger costs, we’ve got you covered.

What factors affect the decision to take an immediate personal loan?

When considering an immediate personal loan, borrowers will want to weigh the risks and rewards of taking on the debt. For example, there are a number of factors that can affect the decision to take on a personal loan. These factors include credit score, income, and current debts.

Credit score is one of the most important factors when deciding whether or not to take on an immediate personal loan. A high credit score means that you are likely to be able to repay your loan in a timely manner, while a low credit score can mean that you will have difficulty paying back your debt. The best way to improve your credit score is by using a credit monitoring service and making on-time payments.

Income is also another important consideration when deciding whether or not to take an immediate personal loan. If you earn a low income, you may need to pay back your loan with more than just your monthly income. For example, if you borrow $2,000 from a bank but have only $1,200 in monthly income, you will need to find another source of funding or risk defaulting on your loan.

Current debts also play a role in whether or not someone should take an immediate personal loan. If you have high-interest debt such as payday loans or car loans with hefty fees attached, taking out an immediate personal loan may not be the best option for you. On the other hand, if you have lower-interest debt such as student loans or department store charges

Conclusion

Kueski is a lending platform that allows you to get quick loans, which can be useful in times of need. The loans are available in a variety of amounts and currencies, so you can find the right loan for your needs. Kueski also offers low interest rates, so you can enjoy an affordable borrowing experience. If you have trouble getting approved for traditional loans, check out what Kueski has to offer – you might be surprised at just how easy it is to get the money you need!

Kueski offers a variety of options for immediate personal loans, including Quick loans. With Quick loans, you can get the money you need fast and without any hassle. Kueski makes it easy to apply for a Quick loan online, and all you need is basic information like your name, address, and social security number. If you have bad credit or no credit history, don’t worry – Kueski has got you covered too. You can still get a Quick loan if your credit score falls below 550. Apply now to find out more about how Quick loans from Kueski can help you solve your financial problems today!