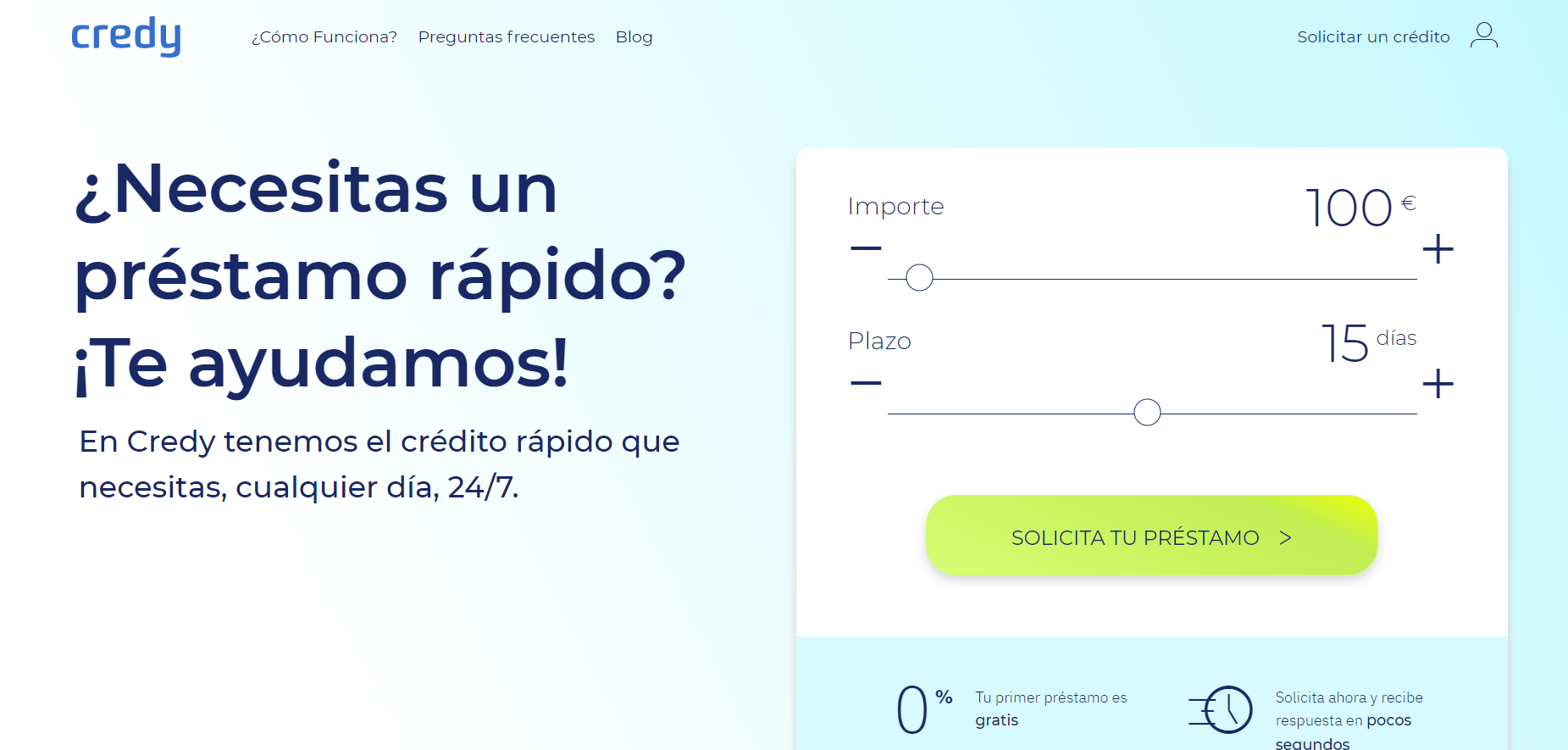

Credy : Get online loans and personal credits in Spain quickly and easily

Financial emergencies or unexpected expenses can happen to anyone. It’s best to be prepared and have a plan in place to help you get through such difficult times. Credy, an online loan provider in Spain, offers quick and easy personal credits and loans at competitive rates. This blog post will explore how Credy works, the types of loans they offer, the benefits of getting a loan from them, and more. We will also discuss what makes Credy different from other loan providers in Spain and why it can be a great option for those who need financial assistance quickly. Read on to learn more about this convenient loan provider!

What is Credy?

Credy is a financial institution that offers online loans and personal credits in Spain. We have more than 10 years of experience in the sector and we are specialists in granting mini-credits and fast loans.

We offer our clients the possibility to obtain the money they need in a simple and fast way, without unnecessary paperwork or delays. In addition, we have a 100% online application process, which means that you can apply for your loan from the comfort of your own home.

At Credy we understand that sometimes you need a little help to make ends meet or to face an unexpected expense, and that’s why we’re here to help. We offer mini-credits of up to € 300 for first-time customers and up to € 600 for returning customers, with repayment terms of up to 30 days.

If you need a little extra help, our team of experts is always available to answer any questions you may have about our products or services. Apply now for your online loan or personal credit and get the money you need in just a few clicks!

How Does Credy Work?

Credy is a financial platform that offers online loans and personal credits in Spain. The company was founded in 2015 by a team of entrepreneurs with experience in the financial sector. Credy’s mission is to help people access the credit they need, quickly and easily.

The Credy platform is simple and easy to use. You can apply for a loan or personal credit in just a few minutes, and you’ll get an instant decision. If you’re approved, the money will be deposited into your account within 24 hours.

Credy offers competitive interest rates and flexible repayment terms. You can choose to repay your loan over 3, 6, 9, or 12 months, and you can make early repayments without penalty.

If you need a loan or personal credit, Credy is a great option. The application process is quick and easy, and you’ll get an instant decision on your loan.

The Benefits of Using Credy

Credy is a service that offers online loans and personal credits in Spain. It is a convenient and easy way to get the money you need when you need it. There are many benefits to using Credy, including:

-You can get approved for a loan or credit in as little as 24 hours

-There is no need for collateral, so you can get the money you need without putting any of your assets at risk

-You can use Credy to consolidate your debts into one monthly payment, making it easier to manage your finances

-Credy offers competitive interest rates and flexible repayment terms, so you can tailor your loan or credit to fit your needs

How to Get Started with Credy

If you’re looking for a quick and easy way to get online loans or personal credits in Spain, Credy is the perfect solution. We offer a simple and convenient online application process, so you can get the money you need fast.

Getting started with Credy is easy. Just fill out our online application and we’ll get back to you within 24 hours with a decision. Once you’re approved, we’ll transfer the funds directly into your bank account so you can start using them right away.

We know that unexpected expenses can pop up at any time, so we offer flexible repayment options to fit your budget. You can choose to repay your loan in full within 30 days, or make smaller monthly payments over 3-12 months. whichever option works best for you.

If you’re ready to get started with Credy, simply head to our website and fill out our online application today.

Credy Alternatives

There are many companies that offer online loans and personal credits in Spain. However, Credy is one of the most popular and trusted companies in this space. If you’re looking for alternatives to Credy, here are a few companies that you can consider:

1. Kredito24: Kredito24 offers online loans of up to €1000 with repayment periods of up to 30 days. They have a simple online application process and offer quick approvals.

2. Vivus: Vivus offers online loans of up to €1500 with repayment periods of up to 45 days. They have a quick and easy online application process and offer same day approvals.

3. Cash Converters: Cash Converters offers online loans of up to €2000 with repayment periods of up to 60 days. They have a simple online application process and offer competitive interest rates.

Conclusion

Credy is a great tool for anyone looking to quickly and easily apply for online loans or personal credits in Spain. With their helpful customer service, fast turnaround times, and competitive rates, Credy makes the process of finding the right loan simple and straightforward. Whether you are looking to start a small business or finance your next vacation, Credy can help make it happen with one quick application!

Credy is the perfect platform for anyone in Spain who needs quick and easy access to online loans and personal credits. They offer competitive rates and a streamlined process that makes it easy to get the funds you need in no time at all. If you’re looking for an online loan or personal credit, Credy has got you covered. With their top-notch customer service, fast response times, and secure payment methods, they make getting the money you need as stress-free as possible. Take advantage of what Credy has to offer today!